-

Dealers of Lightning: Xerox PARC and the Dawn of the Computer Age

Michael A. Hiltzik

Hardcover (Harper Business, March 3, 1999)Dealers of Lightning is the riveting story of the legendary Xerox PARC--a collection of eccentric young inventors brought together by Xerox Corporation at a facility in Palo Alto, California, during the mind-blowing intellectual ferment of the seventies and eighties. Here for the first time Michael Hiltzik, a correspondent for the Los Angeles Times, reveals in piercing detail the true story of the extraordinary group that aimed to bring about a technological dawn that would change the world--and succeeded. Based on extensive interviews with the scientists, engineers, administrators, and corporate executives who lived the story, Dealers of Lightning takes the read on a journey from PARC's beginnings in a dusty, abandoned building at the edge of the Stanford University campus to its triumph as a hothouse of ideas that spawned not only the first personal computer, but the windows-style graphical user interface, the laser printer, much of the indispensable technology of the Internet, and a great deal more. It shows how and why Xerox, despite its willingness to grant PARC unlimited funding and the responsibility for developing breakthroughs to keep the corporation on the cutting edge of office technology, remained forever unable to grasp (and, consequently, exploit) the innovations that PARC delivered--and it details the increasing frustration of the original PARC scientists, many of whom would go on to build their fortunes upon the very ideas Xerox so rashly discarded. More than just a riveting historical narrative, Dealers of Lightning brings to life an unforgettable cast of characters. Among them: Bob Taylor--the preacher's son from rural Texas who would be considered a prophet by some and a cantankerous egomaniac by others, whose fearless (and feared) leadership of a team of computer renegades made them the heroes of the embryonic Silicon Valley; Jack Goldman--the Xerox chief scientist who convinced the stolid corporation to stake tens of millions of dollars on PARC while warning that the investment might not pay off for years--if it paid off at all; Alan Kay--PARC's creative and philosophical soul, who suffered years of ridicule for envisioning a computer that could be tucked under the arm yet would contain the power to store books, symphonies, letters, poems, and drawings--until he arrived at Palo Alto and met the people who would build it; and Steve Jobs--who, aided by Xerox's indifference to PARC's most momentous inventions, staged a daring raid to obtain the technology that would end up at the heart of the Macintosh: the machine that for a time helped Apple dominate an explosive new market. Dealers of Lightning is an unprecedented look at the ideas, the inventions, and the individuals that propelled Xerox PARC to the frontier of technohistory--and the corporate machinations that almost prevented it from achieving greatness.

-

Barbarians at the Gate: The Fall of RJR Nabisco

Bryan Burrough, John Helyar

Hardcover (HarperBusiness, Nov. 1, 2008)A book that stormed both the bestseller list and the public imagination, a book that created a genre of its own, and a book that gets at the heart of Wall Street and the '80s culture it helped define, Barbarians at the Gate has emerged twenty years after the tumultuous deal it so brilliantly recounts as a modern classic—a masterpiece of investigatory journalism and a rollicking book of corporate derring-do and financial swordsmanship. The fight to control RJR Nabisco during October and November of 1988 was more than just the largest takeover in Wall Street history. Marked by brazen displays of ego not seen in American business for decades, it became the high point of a new gilded age and its repercussions are still being felt. The tale remains the ultimate story of greed and glory—a story and a cast of characters that determined the course of global business and redefined how deals would be done and fortunes made in the decades to come. Barbarians at the Gate is the gripping account of these two frenzied months, of deal makers and publicity flaks, of an old-line industrial powerhouse (home of such familiar products a Oreos and Camels) that became the victim of the ruthless and rapacious style of finance in the 1980s. As reporters for The Wall Street Journal, Burrough and Helyar had extensive access to all the characters in this drama. They take the reader behind the scenes at strategy meetings and society dinners, into boardrooms and bedrooms, providing an unprecedentedly detailed look at how financial operations at the highest levels are conducted but also a richly textured social history of wealth at the twilight of the Reagan era. At the center of the huge power struggle is RJR Nabisco's president, the high-living Ross Johnson. It's his secret plan to buy out the company that sets the frenzy in motion, attracting the country's leading takeover players: Henry Kravis, the legendary leveraged-buyout king whose entry into the fray sets off an acquisitive commotion; Peter Cohen, CEO of Shearson Lehman Hutton and Johnson's partner, who needs a victory to propel his company to an unchallenged leadership in the lucrative mergers and acquisitions field; the fiercely independent Ted Forstmann, motivated as much by honor as by his rage at the corruption he sees taking over the business he cherishes; Jim Maher and his ragtag team, struggling to regain credibility for the decimated ranks at First Boston; and an army of desperate bankers, lawyers, and accountants, all drawn inexorably to the greatest prize of their careers—and one of the greatest prizes in the history of American business. Written with the bravado of a novel and researched with the diligence of a sweeping cultural history, Barbarians at the Gate is present at the front line of every battle of the campaign. Here is the unforgettable story of that takeover in all its brutality. In a new afterword specially commissioned for the story's 20th anniversary, Burrough and Helyar return to visit the heroes and villains of this epic story, tracing the fallout of the deal, charting the subsequent success and failure of those involved, and addressing the incredible impact this story—and the book itself—made on the world.

-

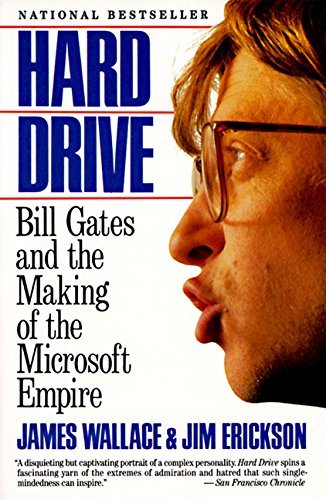

Hard Drive: Bill Gates and the Making of the Microsoft Empire

James Wallace, Jim Erickson

Paperback (Harper Business, June 1, 1993)The true story behind the rise of a tyrannical genius, how he transformed an industry, and why everyone is out to get him.In this fascinating exposé, two investigative reporters trace the hugely successful career of Microsoft founder Bill Gates. Part entrepreneur, part enfant terrible, Gates has become the most powerful -- and feared -- player in the computer industry, and arguably the richest man in America. In Hard Drive, investigative reporters Wallace and Erickson follow Gates from his days as an unkempt thirteen-year-old computer hacker to his present-day status as a ruthless billionaire CEO. More than simply a "revenge of the nerds" story though, this is a balanced analysis of a business triumph, and a stunningly driven personality. The authors have spoken to everyone who knows anything about Bill Gates and Microsoft -- from childhood friends to employees and business rivals who reveal the heights, and limits, of his wizardry. From Gates's singular accomplishments to his equally extraordinary brattiness, arrogance, and hostility (the atmosphere is so intense at Microsoft that stressed-out programmers have been known to ease the tension of their eighty-hour workweeks by exploding homemade bombs), this is a uniquely revealing glimpse of the person who has emerged as the undisputed king of a notoriously brutal industry.

-

Bull: A History of the Boom and Bust, 1982-2004

Maggie Mahar

Paperback (Harper Business, Oct. 12, 2004)In 1982, the Dow hovered below 1000. Then, the market rose and rapidly gained speed until it peaked above 11,000. Noted journalist and financial reporter Maggie Mahar has written the first book on the remarkable bull market that began in 1982 and ended just in the early 2000s. For almost two decades, a colorful cast of characters such as Abby Joseph Cohen, Mary Meeker, Henry Blodget, and Alan Greenspan came to dominate the market news. This inside look at that 17-year cycle of growth, built upon interviews and unparalleled access to the most important analysts, market observers, and fund managers who eagerly tell the tales of excesses, presents the period with a historical perspective and explains what really happened and why.

-

Weaving the Web: The Original Design and Ultimate Destiny of the World Wide Web

Tim Berners-Lee

Paperback (Harper Business, Nov. 7, 2000)Named one of the greatest minds of the 20th century by Time, Tim Berners-Lee is responsible for one of that century's most important advancements: the world wide web. Now, this low-profile genius-who never personally profitted from his invention -offers a compelling protrait of his invention. He reveals the Web's origins and the creation of the now ubiquitous http and www acronyms and shares his views on such critical issues as censorship, privacy, the increasing power of softeware companies , and the need to find the ideal balance between commercial and social forces. He offers insights into the true nature of the Web, showing readers how to use it to its fullest advantage. And he presents his own plan for the Web's future, calling for the active support and participation of programmers, computer manufacturers, and social organizations to manage and maintain this valuable resource so that it can remain a powerful force for social change and an outlet for individual creativity.

-

Flawless Execution: Use the Techniques and Systems of America's Fighter Pilots to Perform at Your Peak and Win the Battles of the Business World

James D Murphy

Hardcover (Harper Business, May 10, 2005)From the former F-15 fighter pilot and CEO of one ofInc.'s 500 fastest-growing companies: ahard-hitting primer on performance excellencein the workplace -- military styleAccording to former U.S. Air Force pilot-turned-management guru James D. Murphy, businesses need to take a lesson from the American military's fighter pilots. While F-15s, F-16s, and F/A-18s are the ultimate aerial combat machines, they are entirely dependent on the men and women who fly and maintain them. At Mach 2, the instrument panel is screaming out information, the horizon is a blur, the wingman is occupied, the pilot's busy, the jet is hanging on the edge -- and yet fighter pilots routinely handle the stress. It's not much different in today's fast-paced, unforgiving world of business. One slipup and the company is bankrupt before the employees know what hit them.What works on the squadron level for F-15 pilots will also work for your marketing team, sales force, or research and development group. By analyzing the work environment and attacking its centers of gravity in parallel, you'll begin to utilize the Plan-Brief-Execute-Debrief-Win cycle that makes up Flawless Execution. The result will make a rapid impact on your business's future success. Developed over the course of nearly fifty years, the rigorous practice of Flawless Execution has helped U.S. fighter squadrons reduce their mistake rate, cut casualties and losses of equipment, and rack up an envious victory record. Through Afterburner's multimedia seminars conducted by "Murph" and his fellow pilots-turned-businesspeople, businesses have benefited by adopting the techniques, systems and strategies of America's Top Guns. Now, with Flawless Execution, you can too.

-

Straight Talk for Startups: 100 Insider Rules for Beating the Odds--From Mastering the Fundamentals to Selecting Investors, Fundraising, Managing Boards, and Achieving Liquidity

Randy Komisar, Jantoon Reigersman

Hardcover (Harper Business, June 5, 2018)"Straight Talk for Startups memorializes age-old best practices and empowers both experienced and new investment professionals to beat the odds."—David Krane, CEO, Google Ventures"Straight Talk for Startups is filled with real, raw, and fact-based ‘rules of the road’ that you need to know when diving into our ultra-competitive startup world. A must read and a re-read!"—Tony Fadell, Coinventor of the iPod/iPhone & Founder of Nest LabsVeteran venture capitalist Randy Komisar and finance executive Jantoon Reigersman share no-nonsense, counterintuitive guidelines to help anyone build a successful startup.Over the course of their careers, Randy Komisar and Jantoon Reigersman continue to see startups crash and burn because they forget the timeless lessons of entrepreneurship.But, as Komisar and Reigersman show, you can beat the odds if you quickly learn what insiders know about what it takes to build a healthy foundation for a thriving venture. In Straight Talk for Startups they walk budding entrepreneurs through 100 essential rules—from pitching your idea to selecting investors to managing your board to deciding how and when to achieve liquidity. Culled from their own decades of experience, as well as the experiences of their many successful colleagues and friends, the rules are organized under broad topics, from "Mastering the Fundamentals" and "Selecting the Right Investors," to "The Ideal Fundraise," "Building and Managing Effective Boards," and "Achieving Liquidity."Vital rules you’ll find in Straight Talk for Startups include:The best ideas originate from founders who are usersCreate two business plans: an execution plan and an aspirational planNet income is an option, but cash flow is a factDon’t accept money from strangersPersonal wealth doesn’t equal good investingSmall boards are better than big onesAdd independent board members for expertise and objectivityToo many unanimous board decisions are a sign of troubleChoose an acquirer, don’t wait to be chosenLearn the rules by heart so you know when to break themFilled with helpful real-life examples and specific, actionable advice, Straight Talk for Startups is the ideal handbook for anyone running, working for, or thinking about creating a startup, or just curious about what makes high-potential ventures tick.

-

The Complete TurtleTrader: The Legend, the Lessons, the Results

Michael W Covel

Hardcover (Harper Business, Oct. 9, 2007)This is the true story behind Wall Street legend Richard Dennis, his disciples, the Turtles, and the trading techniques that made them millionaires.What happens when ordinary people are taught a system to make extraordinary money? Richard Dennis made a fortune on Wall Street by investing according to a few simple rules. Convinced that great trading was a skill that could be taught to anyone, he made a bet with his partner and ran a classified ad in the Wall Street Journal looking for novices to train. His recruits, later known as the Turtles, had anything but traditional Wall Street backgrounds; they included a professional blackjack player, a pianist, and a fantasy game designer. For two weeks, Dennis taught them his investment rules and philosophy, and set them loose to start trading, each with a million dollars of his money. By the time the experiment ended, Dennis had made a hundred million dollars from his Turtles and created one killer Wall Street legend. In The Complete Turtle Trader, Michael W. Covel, bestselling author of Trend Following and managing editor of TurtleTrader.com, the leading website on the Turtles, tells their riveting story with the first ever on the record interviews with individual Turtles. He describes how Dennis interviewed and selected his students, details their education and experiences while working for him, and breaks down the Turtle system and rules in full. He reveals how they made astounding fortunes, and follows their lives from the original experiment to the present day. Some have grown even wealthier than ever, and include some of today's top hedge fund managers. Equally important are those who passed along their approach to a second generation of Turtles, proving that the Turtles' system truly is reproducible, and that anyone with the discipline and the desire to succeed can do as well as—or even better than—Wall Street's top hedge fund wizards.In an era full of slapdash investing advice and promises of hot stock tips for "the next big thing," as popularized by pundits like Jim Cramer of Mad Money, the easy-to-follow objective rules of the TurtleTrader stand out as a sound guide for truly making the most out of your money. These rules worked—and still work today—for the Turtles, and any other investor with the desire and commitment to learn from one of the greatest investing stories of all time.

-

Leaving Microsoft to Change the World: An Entrepreneur's Odyssey to Educate the World's Children

John Wood

Hardcover (HarperBusiness, Aug. 29, 2006)John Wood discovered his passion, his greatest success, and his life's work—not at business school or leading Microsoft's charge into Asia in the 1990s—but on a soul-searching trip to the Himalayas. Wood felt trapped between an all-consuming career and a desire to do something lasting and significant. Stressed from the demands of his job, he took a vacation trekking in Nepal because a friend had told him, "If you get high enough in the mountains, you can't hear Steve Ballmer yelling at you anymore."Instead of being the antidote to the rat race, that trip convinced John Wood to divert the boundless energy he was devoting to Microsoft into a cause that desperately needed to be addressed. While visiting a remote Nepalese school, Wood learned that the students had few books in their library. When he offered to run a book drive to provide the school with books, his idea was met with polite skepticism. After all, no matter how well-intentioned, why would a successful software executive take valuable time out of his life and gather books for an impoverished school?But John Wood did return to that school and with thousands of books bundled on the back of a yak. And at that moment, Wood made the decision to walk away from Microsoft and create Room to Read—an organization that has donated more than 1.2 million books, established more than 2,600 libraries and 200 schools, and sent 1,700 girls to school on scholarship—ultimately touching the lives of 875,000 children with the lifelong gift of education.Leaving Microsoft to Change the World chronicles John Wood's struggle to find a meaningful outlet for his managerial talents and entrepreneurial zeal. For every high-achiever who has ever wondered what life might be like giving back, Wood offers a vivid, emotional, and absorbing tale of how to take the lessons learned at a hard-charging company like Microsoft and apply them to one of the world's most pressing problems: the lack of basic literacy.

-

The IRS Problem Solver: From Audits to Assessments--How to Solve Your Tax Problems and Keep the IRS Off Your Back Forever

Daniel J. Pilla

Paperback (Harper Business, Dec. 23, 2003)Are you burdened with the tax debt of a current or former spouse? Have you just received an IRS computerized or "correction" notice? Are you in danger of having your property seized? Has your tax return been selected for an audit?Is the IRS knocking on your door? If you've answered "yes" to any of these questions, you're not alone: more than twenty-five million taxpayers are faced with the terrifying prospect of dealing with audits, assessments, or other IRS problems every year. But with all the books devoted to how to prepare your taxes, there's never been one that explains how to get yourself out of trouble easily, legally, and inexpensively -- until now. With The IRS Problem Solver, veteran tax expert Dan Pilla offers the first comprehensive guide to dealing with the most common IRS problems taxpayers confront, from face-to-face audits to fraud penalties. Pilla's book is an indispensable preventive tool for all who file their own taxes—and a necessity for anyone who's just received a notice that the wolf is at the door.

-

Leaving Microsoft to Change the World an entrepreneurs odyssey to educate the worlds children 2006 paperback

John Wood

Paperback (HarperBusiness, March 15, 2006)Leaving Microsoft to Change the World: An Entrepreneurs Odyssey to Educate the World s Children by Wood. HarperCollins Publishers,2006

-

Only Humans Need Apply: Winners and Losers in the Age of Smart Machines

Thomas H. Davenport, Julia Kirby

Hardcover (Harper Business, May 24, 2016)An invigorating, thought-provoking, and positive look at the rise of automation that explores how professionals across industries can find sustainable careers in the near future.Nearly half of all working Americans could risk losing their jobs because of technology. It’s not only blue-collar jobs at stake. Millions of educated knowledge workers—writers, paralegals, assistants, medical technicians—are threatened by accelerating advances in artificial intelligence.The industrial revolution shifted workers from farms to factories. In the first era of automation, machines relieved humans of manually exhausting work. Today, Era Two of automation continues to wash across the entire services-based economy that has replaced jobs in agriculture and manufacturing. Era Three, and the rise of AI, is dawning. Smart computers are demonstrating they are capable of making better decisions than humans. Brilliant technologies can now decide, learn, predict, and even comprehend much faster and more accurately than the human brain, and their progress is accelerating. Where will this leave lawyers, nurses, teachers, and editors?In Only Humans Need Apply, Thomas Hayes Davenport and Julia Kirby reframe the conversation about automation, arguing that the future of increased productivity and business success isn’t either human or machine. It’s both. The key is augmentation, utilizing technology to help humans work better, smarter, and faster. Instead of viewing these machines as competitive interlopers, we can see them as partners and collaborators in creative problem solving as we move into the next era. The choice is ours.