-

Talks to Teachers on Psychology and to Students on Some of Life's Ideals

William James

eBook (Adamant Media Corporation, Nov. 24, 2000)This Elibron Classics book is a reprint of a 1899 edition by Longmans, Green & Company, London, New York, Bombay.

-

The Wind that Shakes the Barley

Barke James William

eBookNo description available.

-

STOCK MARKET INVESTING FOR BEGINNERS: AN EASY AND SIMPLE GUIDE TO MAKE MONEY IN STOCK MARKET

WILLIAM JAMES

eBookStock market is like a maze. To invest in stocks one needs to have a thorough knowledge about the investments and different stocks. Everything you wanted to know about Stock Market Investing is a book that tells us in a very simple language all aspects of stock market investing and the issues concerned. It is a comprehensive study of all the data, analysis tools and support that you need before investing.All forms of investment share a common purpose: to provide for a better future. Stock market investing is one of the best tools you can use to build a more secure financial foundation for you and your family. However, for those of us who aren't professional stockbrokers, the process of stock market investing can seem complex and bewildering. History has shown that investing in stocks is one of the easiest and most profitable ways to build wealth over the long-term. With a handful of notable exceptions, almost every member of the Forbes 400 list got there because they own a large block of shares in a public or private corporation. Although your beginning may be humble, this guide to investing in stocks will explain what stocks are, how you can make money from them, and much more.If you’re not well-versed in the basics of the stock market, the words and numbers spewed from CNBC or the markets section of your favorite newspaper can border on gibberish.Phrases like “earnings movers” and “intraday highs” don’t mean much to the average investor, and in many cases, they shouldn’t. If you’re in it for the long term — with, say, a portfolio of mutual funds geared toward retirement — you don’t need to worry about this lingo, or about the flashes of red or green that cross the bottom of your TV screen. You can get by just fine without watching the market much at all.But if you’re interested in trading stocks, you need to start with some basic knowledge about how the stock market works.Watching the stock markets rise and fall, you can imagine why a total beginner might be frozen with fear.A thousand points in six months! Two hundred point drops! Booms and busts! Which are the best investments, our novice rightly asks.Well, first of all, let's put that volatility into some much-needed perspective. Yes, 2008 and 2009 were seriously frightening years for stock investors. A decline in the Dow Jones average from above 14,000 down to 6,626 was hair-raising.But we're back above 15,500 now, just four years and a few months on. Unless you expected to retire in March 2009, the move — while dramatic — was not relevant to you.Yes, it was relevant to everyone, of course. But, if you are a stock buyer, which by definition most of us are, a decline is welcome news, not a reason to give up. Prices fell. Bargains were everywhere.Ah, you might say, but who buys at market bottoms other than traders and crazy people? Well, index investors do it all the time. Portfolio indexing is nothing more than holding a variety of investments in precise measures, according to your tolerance for investment volatility and how long you have until you retire.Some of these investments are dividend payers. Some are interest-paying bonds. Presumably, you are working and saving money to invest with every paycheck. Stock Market BasicsThe stock market refers to the collection of markets and exchanges where the issuing and trading of equities (stocks of publicly held companies), bonds and other sorts of securities takes place, either through formal exchanges or over-the-counter markets. Also known as the equity market, the stock market is one of the most vital components of a free-market economy, as it provides companies with access to capital in exchange for giving investors a slice of ownership.DOWNLOAD YOUR COPY NOW.

-

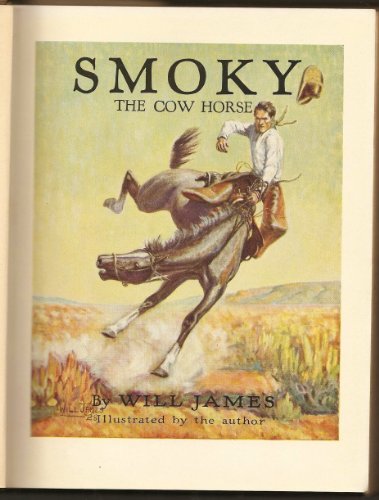

Smoky, the cow horse, by Will James, illustrated by the author

Will James

Hardcover (Charles Scribner's Sons, Jan. 1, 1929)None

-

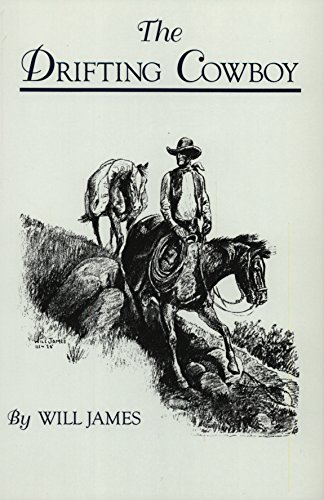

The Drifting Cowboy

Will James

eBook (Bareback Publishing, )None

-

Talks to Teachers on Psychology; And to Students on Some of Life's Ideals

William James

eBook (BookRix GmbH & Co. KG, March 20, 2014)In 1892 I was asked by the Harvard Corporation to give a few public lectures on psychology to the Cambridge teachers. The talks now printed form the substance of that course, which has since then been delivered at various places to various teacher-audiences. I have found by experience that what my hearers seem least to relish is analytical technicality, and what they most care for is concrete practical application. So I have gradually weeded out the former, and left the latter unreduced; and now, that I have at last written out the lectures, they contain a minimum of what is deemed 'scientific' in psychology, and are practical and popular in the extreme.

-

PRAGMATISM: A New Name for Some Old Ways of Thinking

William James

Paperback (Maven Books, Nov. 18, 2019)The lectures that follow were delivered at the Lowell Institute in Boston in November and December, 1906, and in January, 1907, at Columbia University, in New York. They are printed as delivered, without developments or notes. The pragmatic movement, so-called—I do not like the name, but apparently it is too late to change it—seems to have rather suddenly precipitated itself out of the air. A number of tendencies that have always existed in philosophy have all at once become conscious of themselves collectively, and of their combined mission; and this has occurred in so many countries, and from so many different points of view, that much unconcerted statement has resulted. I have sought to unify the picture as it presents itself to my own eyes, dealing in broad strokes, and avoiding minute controversy. Much futile controversy might have been avoided, I believe, if our critics had been willing to wait until we got our message fairly out. Contents: Expanded Contents, Lecture I - The Present Dilemma in Philosophy, Lecture II - What Pragmatism Means, Lecture III - Some Metaphysical Problems Pragmatically Considered, Lecture IV - The One and the Many, Lecture V - Pragmatism and Common Sense, Lecture VI - Pragmatism’s Conception of Truth, Lecture VII - Pragmatism and Humanism, Lecture VIII - Pragmatism and Religion.

-

Elf Bane: A Tale of the Dwemhar

J.T. Williams

Paperback (Independently published, May 3, 2019)The Northern gods watch over them.Valrin and his companions narrowly escaped their deaths and flee east. By chance, they have learned of a gaseous poison in the hands of the dwarves capable of slaughtering thousands. How will the Stormborn, with the power of the ancients at his command, find a way to stop them?Now, he must trust his shadow elf friend in seeking out the mysterious daughter of the Ice Mage. With her power of elemental magic and sorcery unlike any before her, she could prove a powerful ally. But will her own dark secret hinder his own task as Stormborn?He struggles to trust the one person they risked their lives to save as shadows descend upon the crew. Calling upon every ounce of his courage to survive the coming bloodshed, he may have no choice but to go to the one place that could ensure the death of them all. But will courage be enough?This is not your typical coming of age adventure. The explosive conclusion to the sword and sorcery novella trilogy Stormborn Saga is packed with some of the darkest scenes of the trilogy!

-

Petronella

Jay Williams

Hardcover (Parents' Magazine Press, Jan. 1, 1973)Determined not to be outdone by her brothers in seeking a fortune in the world, a young princess sets out to find a prince to rescue.

-

Talks To Teachers On Psychology: And To Students On Some Of Life's Ideals

William James

Paperback (CreateSpace Independent Publishing Platform, May 18, 2016)In writing these “Talks” out, the author has gradually weeded out as much as possible of the analytical technicalities of the science. In their present form they contain a minimum of what is deemed “scientific” in psychology and are practical and popular in the extreme. “He combines, better than most writers, the thoroughly scientific with the truly practical, having something of value on every page for every teacher of every grade.” -L. H. Jones, Superintendent of Schools, Cleveland, Ohio “The psychology that forms the basis of the ‘Talks’ is presented in beautifully clear and simple English and well illustrated by examples drawn from the field of common observation. One can hardly help feeling as he reads that if psychology is not here shorn of its terrors for teachers, no other writer need hope to accomplish that task.” -The Dial “It is an admirable book – frank, suggestive, stimulating, like everything else the author has written.” -J. P. Gordy, Professor in Ohio State University, Columbus “James is a genius. His mental touch is quickening; his style grips attention; his thoughts teem with suggestion. He is a whole-souled, genial, witty man, as well as a great psychologist. A wizard at putting things.” -The Wooster Post-Graduate and Quarterly “A work of absorbing interest.” -Boston Transcript “His style has the quality of a communicable fervor, a clear, grave passion of sincerity and conviction.” -The Nation “When pedagogical libraries can show a preponderance of such books, they may well begin to rival the fiction departments in popularity.” -The Critic Table of Contents Preface Psychology and the Teaching Art The Stream of Consciousness The Child as a Behaving Organism Education and Behavior The Necessity of Reactions Native Reactions and Acquired Reactions What the Native Reactions are The Laws of Habit The Association of Ideas Interest Attention Memory The Acquisition of Ideas Apperception The Will Talks to Students on Some of Life’s Ideals

-

Pray it Kiddo

James E. Williams

Paperback (lulu.com, Feb. 22, 2017)Brother and sister, Manny and Mary embark on another faith building journey, that teaches them to pray Gods word into real life situations, which pleases God, and gets him involved in their lives.

-

Talks To Teachers On Psychology; And To Students On Some Of Life's Ideals

William James

Hardcover (Pinnacle Press, May 24, 2017)This work has been selected by scholars as being culturally important and is part of the knowledge base of civilization as we know it.This work is in the public domain in the United States of America, and possibly other nations. Within the United States, you may freely copy and distribute this work, as no entity (individual or corporate) has a copyright on the body of the work.Scholars believe, and we concur, that this work is important enough to be preserved, reproduced, and made generally available to the public. To ensure a quality reading experience, this work has been proofread and republished using a format that seamlessly blends the original graphical elements with text in an easy-to-read typeface.We appreciate your support of the preservation process, and thank you for being an important part of keeping this knowledge alive and relevant.